Edition #14 | September 9 -> 16

A hand-made curation of the most interesting content we came across last week, powered by AI 🤖👇

Dear readers, click the title or 'View entire message' for optimal viewing if clipped. Remember, we aim to provide valuable insights, but this newsletter is for informational purposes only, not financial advice. Our full disclaimer is at the end.

Now, let's dive into this week's curated content.

[Quote of the Week]

https://fs.blog/brain-food/september-1-2024/

“Too many people want to be something to everyone and end up being nothing to anyone. Universal appeal means universal indifference.”

[Podcast]

An (experimental) conversation from the hand-made curation of the most interesting content we came across last week, powered Google's NotebookLM:

[Summary]

The global economic landscape is experiencing significant shifts, with mixed signals in the US economy, record-high global debt, and China facing potential deflation. Geopolitical tensions persist, particularly between the US and China, while energy demands continue to rise, led by China's exponential growth. Technological advancements, especially in AI, are reshaping various sectors, though debates about its limitations in creative fields continue. The housing market shows a complex picture of recovery and affordability challenges, while cryptocurrency and digital finance initiatives, particularly from China, could potentially revolutionize global financial systems.

[Expanded Summary]

Economics and Finance:

• The US economy is showing mixed signals, with core services inflation accelerating while overall Consumer Price Index (CPI) is decelerating, creating a complex economic picture.

• Global debt has reached a new record high of $315 trillion, with mature markets accounting for two-thirds of this total, raising concerns about long-term financial stability.

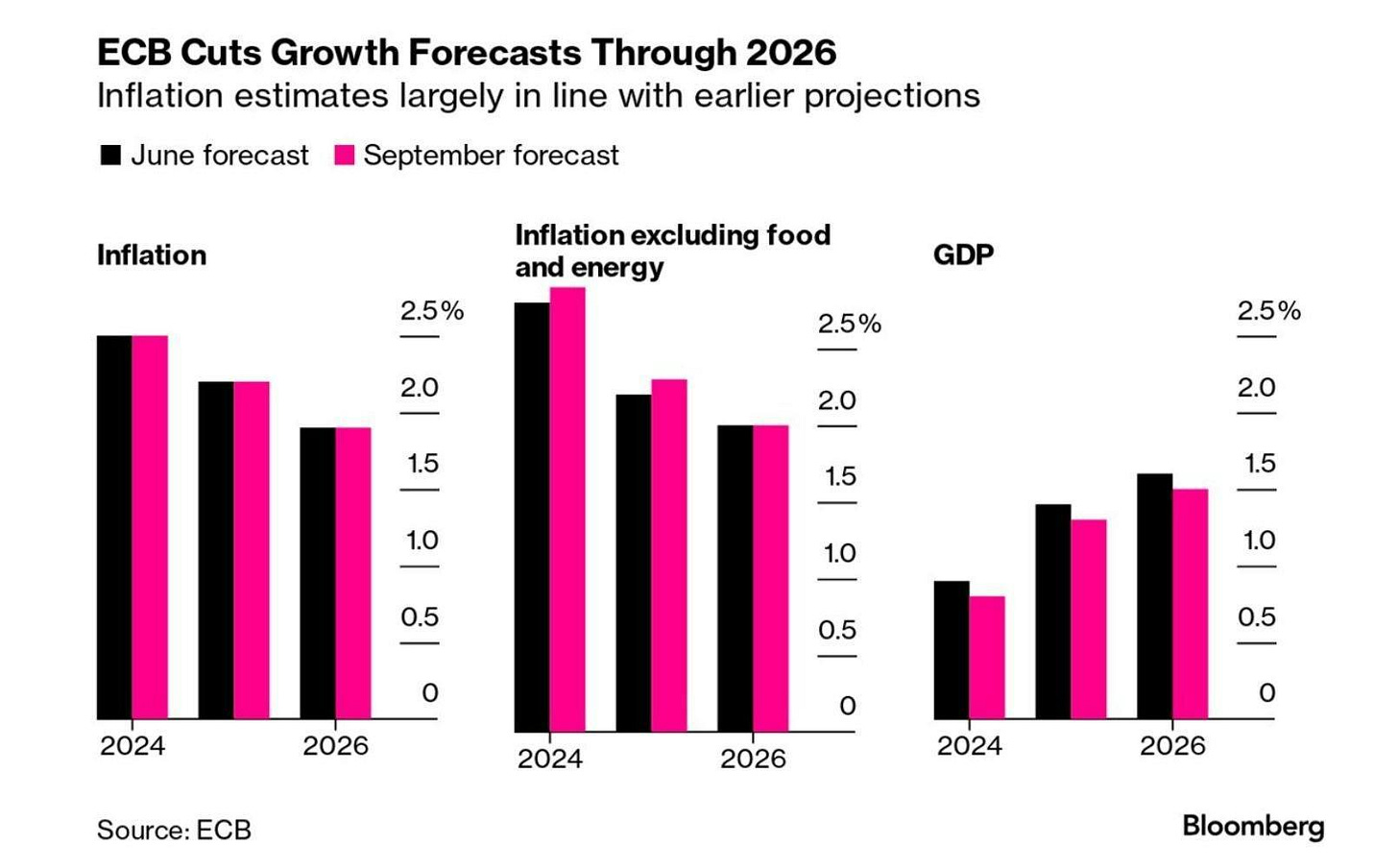

• The European Central Bank has cut interest rates in an effort to stimulate economic activity, responding to signs of slowing growth in the region.

• Structural factors driving high US fiscal deficits, including demographic pressures and political polarization, are likely to persist, making meaningful deficit reduction unlikely in the near term.

• Financial markets appear to be at a turning point, with expectations of higher inflation, interest rates, and volatility in the coming years, potentially reshaping investment strategies.

Geopolitics and International Relations:

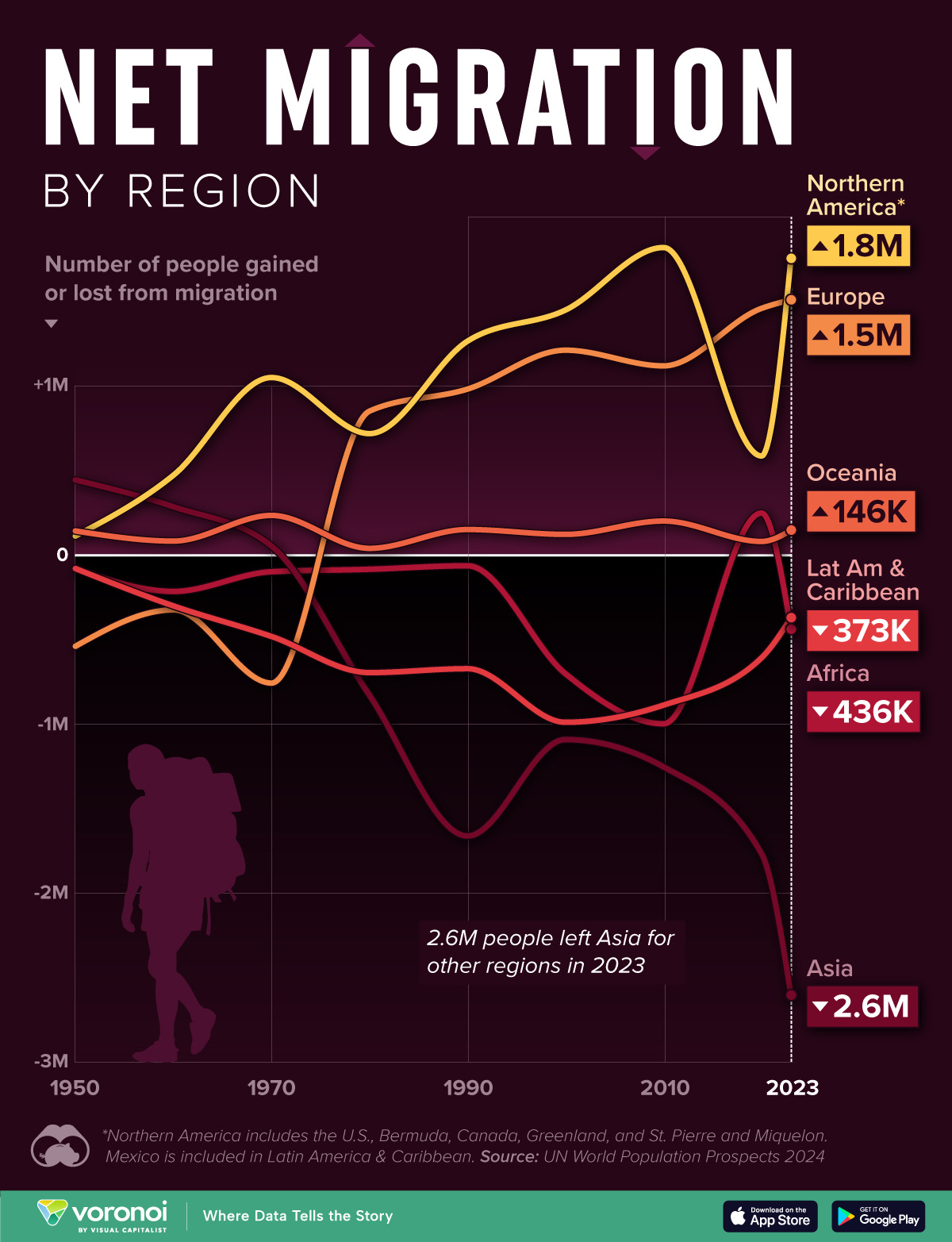

• Global migration patterns reveal consistent population gains in Northern America, Europe, and Oceania, while Latin America, Africa, and Asia are experiencing net population losses.

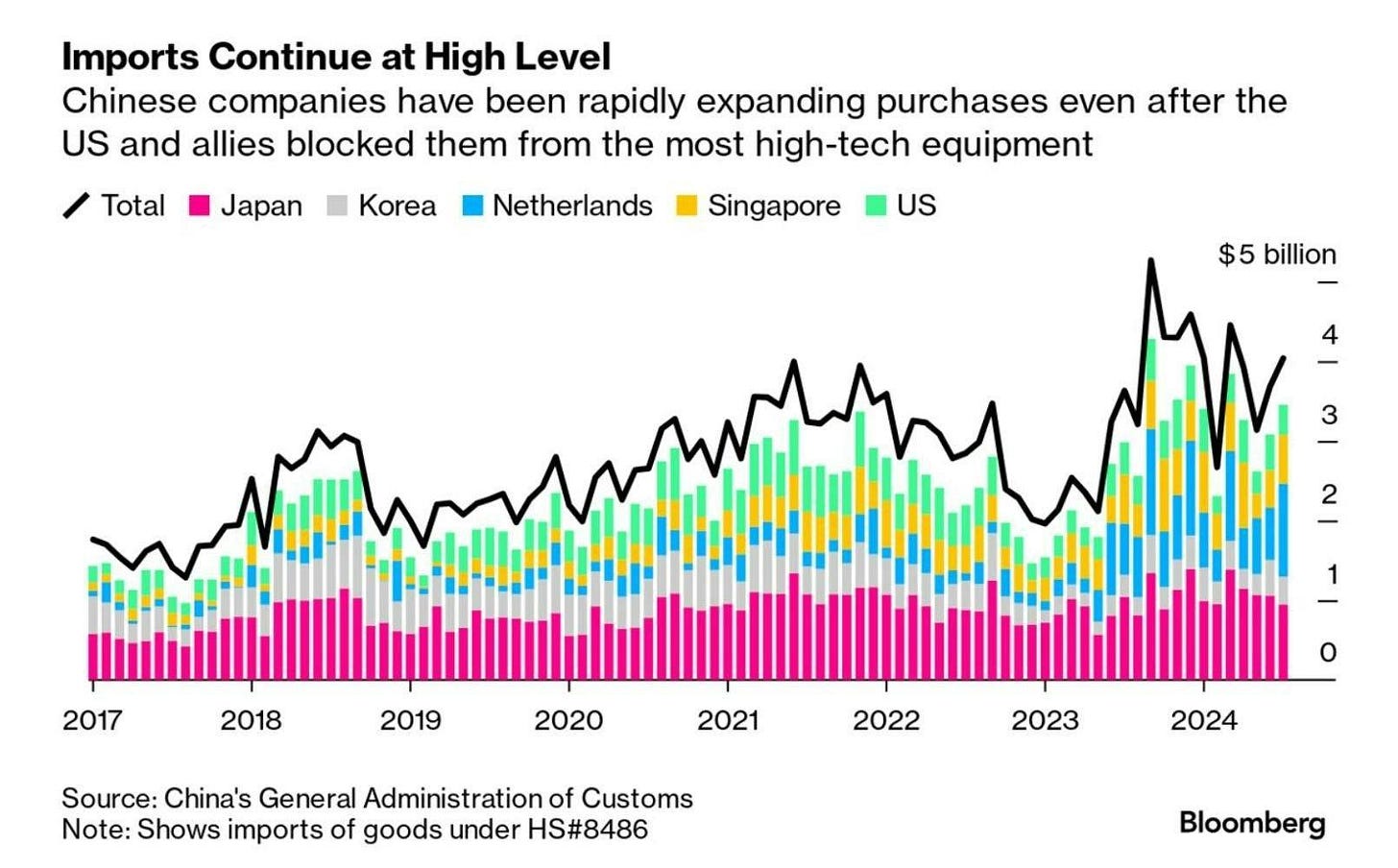

• Tensions between the United States and China remain high, with both countries maintaining their positions as the world's most powerful nations, influencing global economic and political dynamics.

• The US presidential race is heating up, with debates focusing heavily on economic issues, reflecting the importance of financial concerns to voters.

• A second assassination attempt on former President Donald Trump has raised security concerns and could potentially impact the political landscape.

• El Salvador's proposal to use cryptocurrency for trade with BRICS nations signals a potential shift away from US dollar dominance, potentially reshaping global economic relationships.

Energy and Commodities:

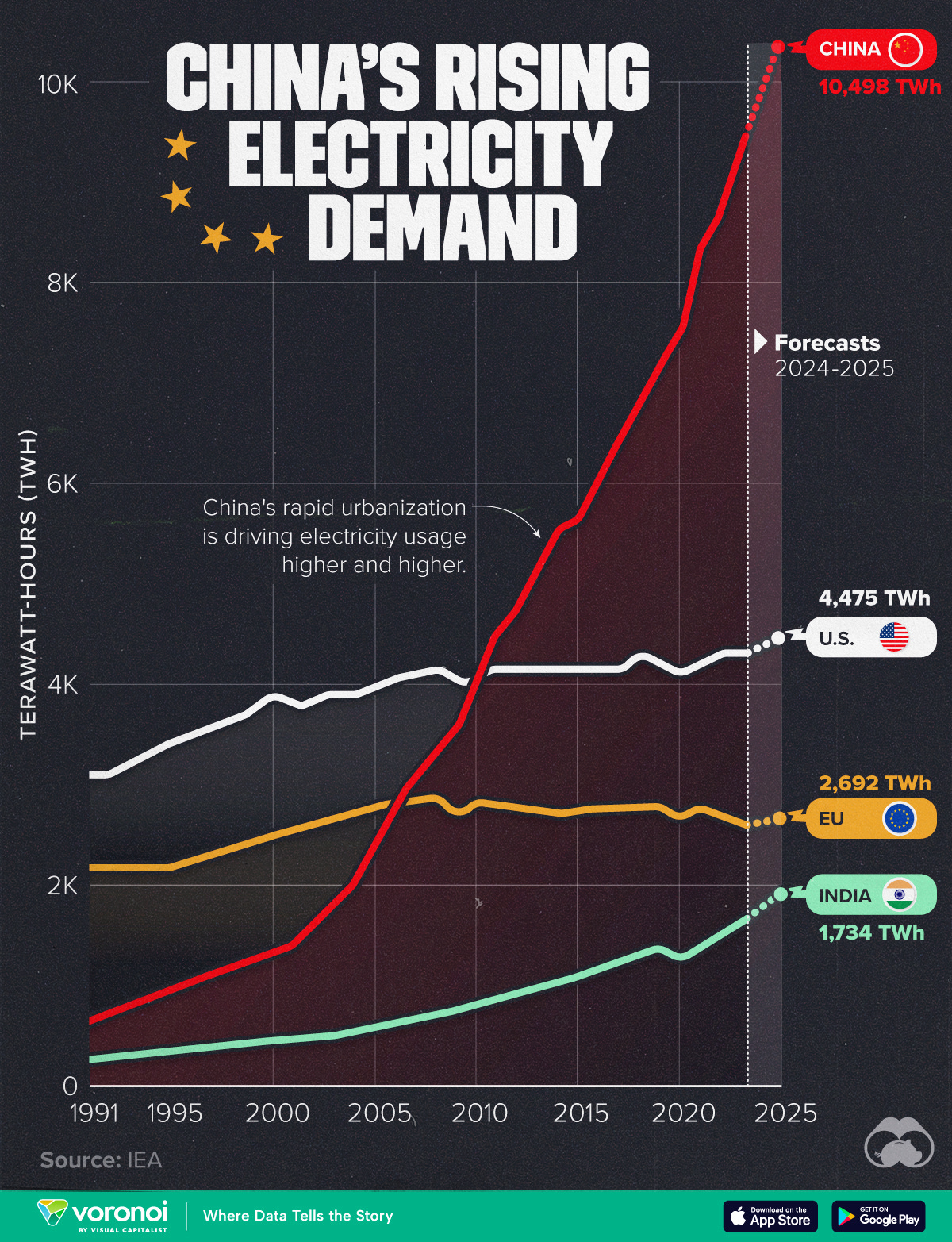

• China's electricity demand continues to grow exponentially, with projections indicating it will more than double that of the United States by 2025, highlighting the country's rapid development.

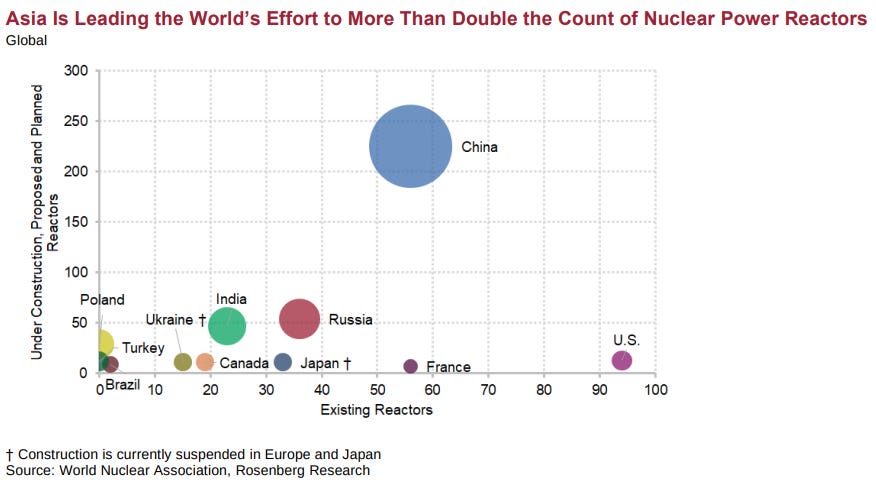

• Asia, led by China, is spearheading a global effort to expand nuclear power capacity, potentially reshaping the global energy landscape.

• OPEC's influence on global oil markets is waning due to increased competition from US shale production and technological advancements in the energy sector.

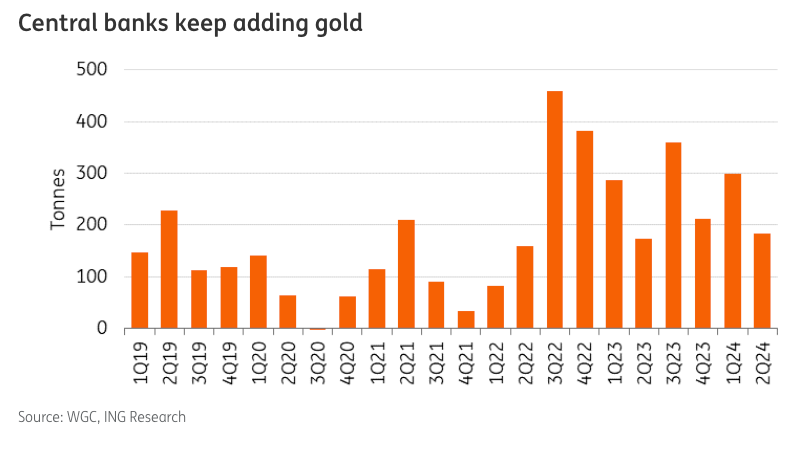

• Gold has surged over 20% year-to-date, driven by anticipated Federal Reserve rate cuts and ongoing geopolitical risks, underscoring its role as a safe-haven asset.

• China's steel overproduction has led to a 20% price drop this year, prompting protective measures from Europe and affecting global commodity markets.

Technology and AI:

• TikTok is facing a legal battle in the United States over national security concerns, with potential significant impacts on its future operations in the country.

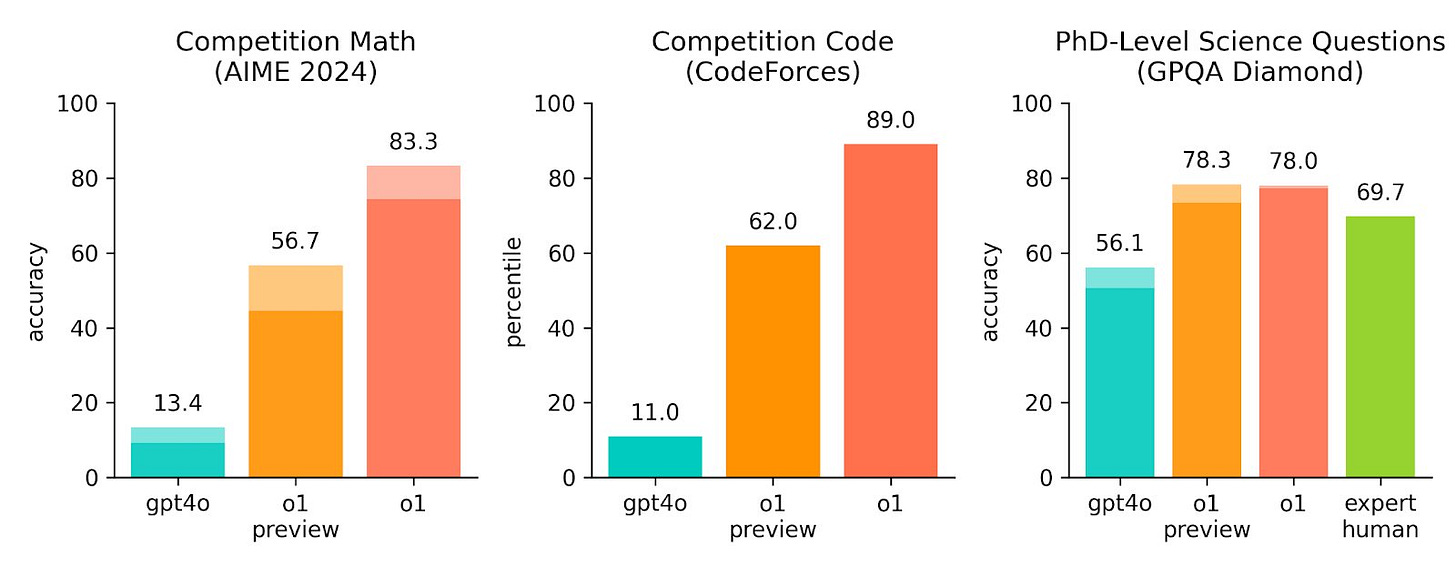

• OpenAI has released a new AI model with enhanced reasoning capabilities, potentially advancing the field of artificial intelligence and its applications.

• A study on AI's impact on entrepreneurial performance reveals mixed results, with high-performing entrepreneurs benefiting while low performers experienced declines.

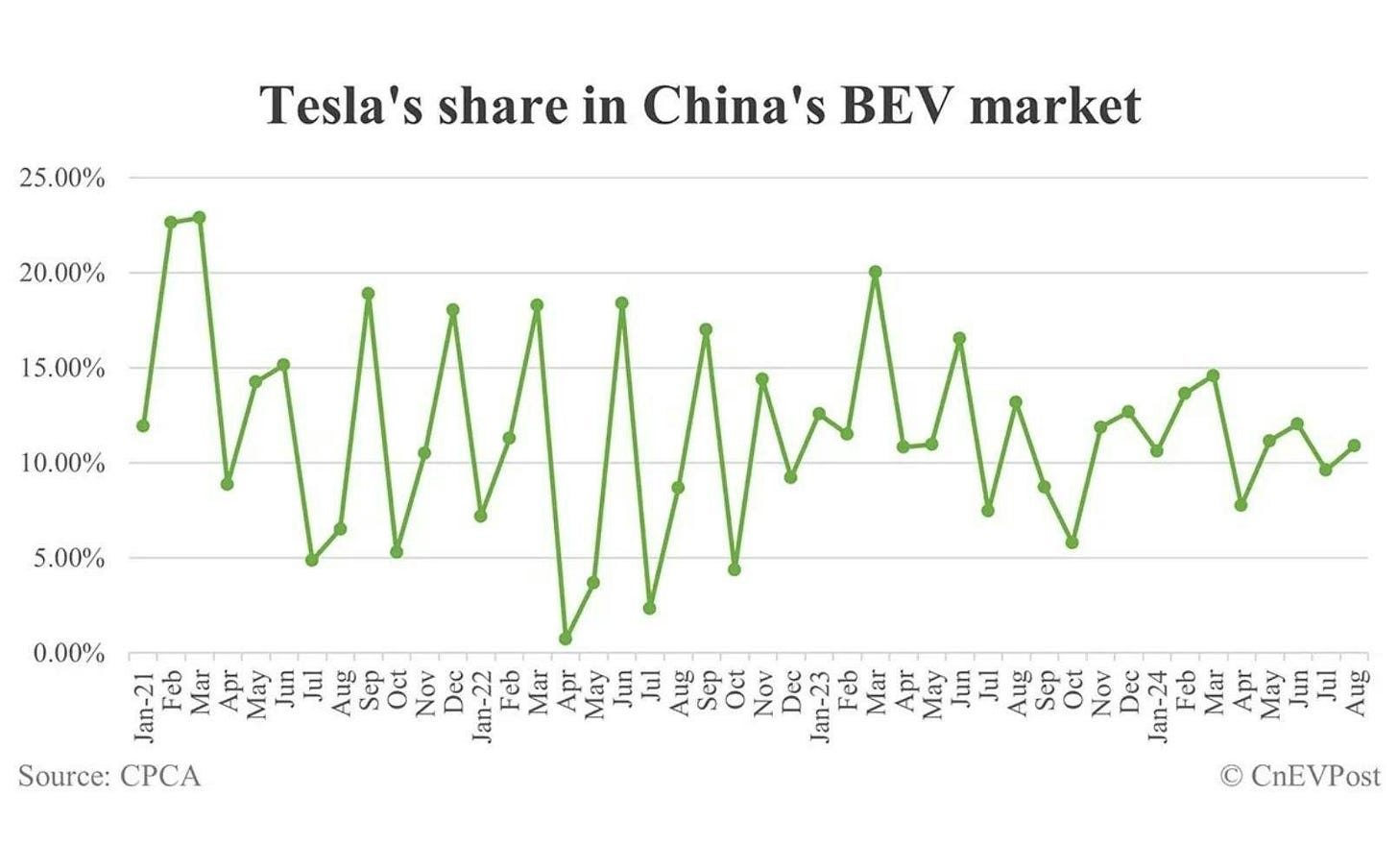

• The integration of AI in various sectors continues, with companies like Tesla exploring collaborations to enhance their technologies, particularly in autonomous driving.

• Debates persist about AI's role in creative fields, with some arguing that AI fundamentally lacks the ability to create meaningful art due to its inability to replicate human experiences and intentions.

Real Estate and Housing:

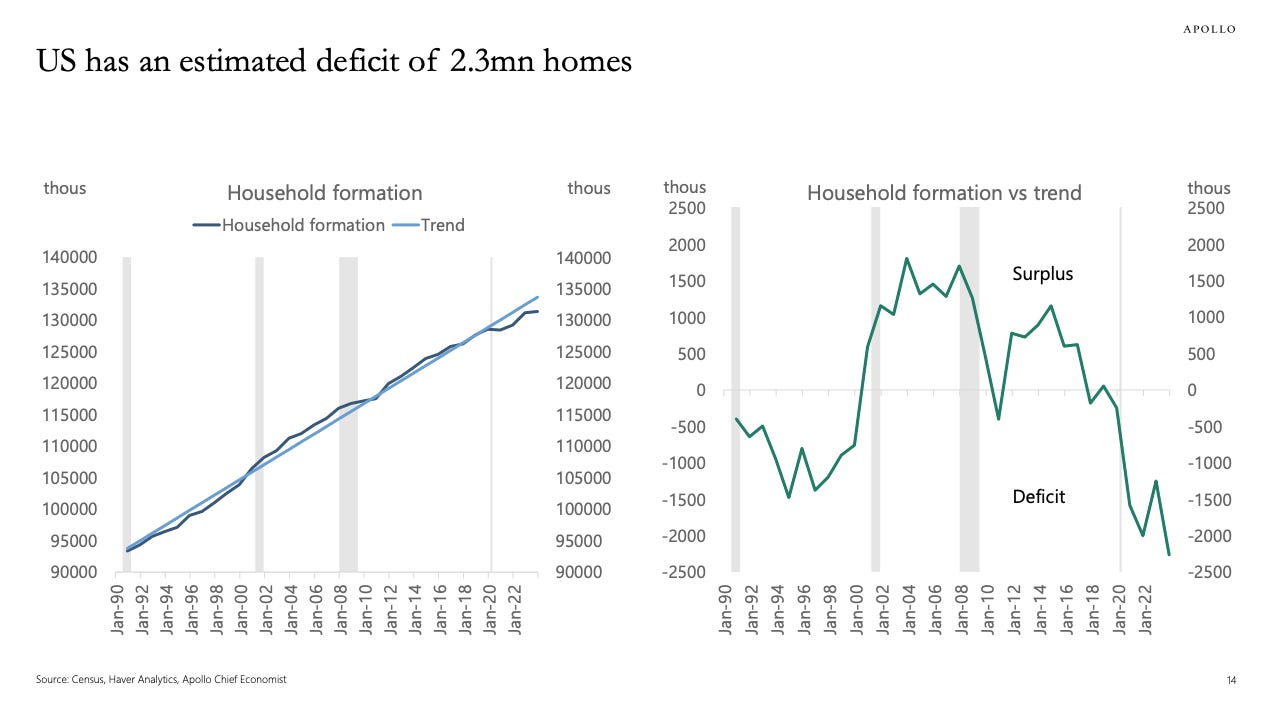

• The US housing market recovery continues, primarily driven by low supply, but demand is softening due to high mortgage rates and elevated home prices.

• An estimated deficit of 2.3 million homes in the US is contributing to the ongoing supply constraints in the housing market.

• High-earning households are showing significant migration patterns, with Florida gaining the most and California losing the most high-income residents, potentially impacting local economies and housing markets.

Cryptocurrency and Digital Finance:

• China is planning to leverage its vast US dollar reserves to create a digital currency system, potentially revolutionizing global finance and challenging US financial dominance.

• El Salvador's proposal to use cryptocurrency for trade with BRICS nations, particularly Russia, aims to move away from the US dollar and could simplify trade dealings while potentially leading to El Salvador joining BRICS.

• The failure of Flowcarbon, an environmental tech startup co-founded by former WeWork CEO Adam Neumann, to launch its promised cryptocurrency token raises questions about the viability of certain crypto ventures and the due diligence of high-profile investors.

[Economics]

https://wolfstreet.com/2024/09/11/beneath-the-skin-of-cpi-inflation-core-cpi-again-accelerates-month-to-month-fueled-by-hot-core-services-cpi-durable-goods-prices-drop-further/

The Consumer Price Index (CPI) for August 2024 showed mixed signals, with core services inflation accelerating for the second consecutive month, driven by a 5.0% annualized increase in core services CPI. Overall CPI rose 2.5% year-over-year, decelerating from July due to falling energy prices and stable food costs. Core CPI accelerated slightly to 3.20% year-over-year, with services pushing it up while durable goods prices continued to decline.

https://bilello.blog/2024/the-week-in-charts-9-9-24

The longest yield curve inversion in history has ended, with the 10-year Treasury yield now slightly above the 2-year yield. Historically, such reversals have preceded recessions within months. However, the 3-month/10-year curve remains inverted, awaiting Fed rate cuts. While aggressive rate cuts might signal recession fears, the author notes that a recession isn't inevitable, though odds favor economic weakness ahead given the yield curve's historical reliability as an indicator.

https://www.apolloacademy.com/wp-content/uploads/2024/09/DailyAndWeeklyIndicatorsForTheUSEconomy-090724.pdf

Multiple economic indicators suggest a potential soft landing for the US economy, including declining unemployment, accelerating wage growth, robust consumer spending, solid retail sales, decreasing jobless claims, lower default rates, positive GDP forecasts, high profit margins, and potential job market improvements. While these factors indicate strength, economic conditions can change rapidly, and ongoing monitoring is necessary to confirm the absence of recession risks.

https://www.lynalden.com/september-2024-newsletter/

Structural factors driving high U.S. fiscal deficits, including demographic pressures on Social Security, inefficient healthcare spending, accumulated debt interest, political polarization, and financialization of tax receipts, make meaningful deficit reduction unlikely in the near term. This fiscal dominance will likely impact investors through higher inflation, asset price distortions, and shifts in relative performance across asset classes, necessitating a reconsideration of traditional investment strategies.

https://www.visualcapitalist.com/charted-315-trillion-in-global-debt-by-sector/

Global debt reached a new record high of $315 trillion in Q1 2024, with mature markets accounting for two-thirds of the total at $209.7 trillion. This increase marks the second consecutive quarter of rising global debt, driven by a $1.3 trillion uptick from the previous quarter. Emerging markets' debt has doubled over the past decade, now exceeding $105 trillion.

https://finimize.com/content/bail-out

The European Central Bank (ECB) cut interest rates by 0.25 percentage points to 3.5% on Thursday, marking its second rate cut this year. This decision comes as the European economy shows signs of slowing down, with reduced consumer spending and a pullback in international demand for manufacturers. The move aims to stimulate economic activity and address concerns about economic growth.

https://www.euronews.com/my-europe/2024/09/09/draghis-report-on-eu-competitiveness-five-key-takeaways

Mario Draghi’s report on European Union competitiveness outlines a series of urgent recommendations to address Europe’s economic challenges and global positioning. The report stresses the need for coordinated action, substantial financial mobilization, and reforms to ensure Europe’s ability to compete with global powers like the US and China. Draghi’s five key takeaways include increasing investment through common debt, addressing the growing economic threat posed by China, boosting innovation, implementing a cohesive industrial strategy, and reforming the EU’s decision-making processes to be more efficient and less bureaucratic.

https://finimize.com/content/on-the-precipice

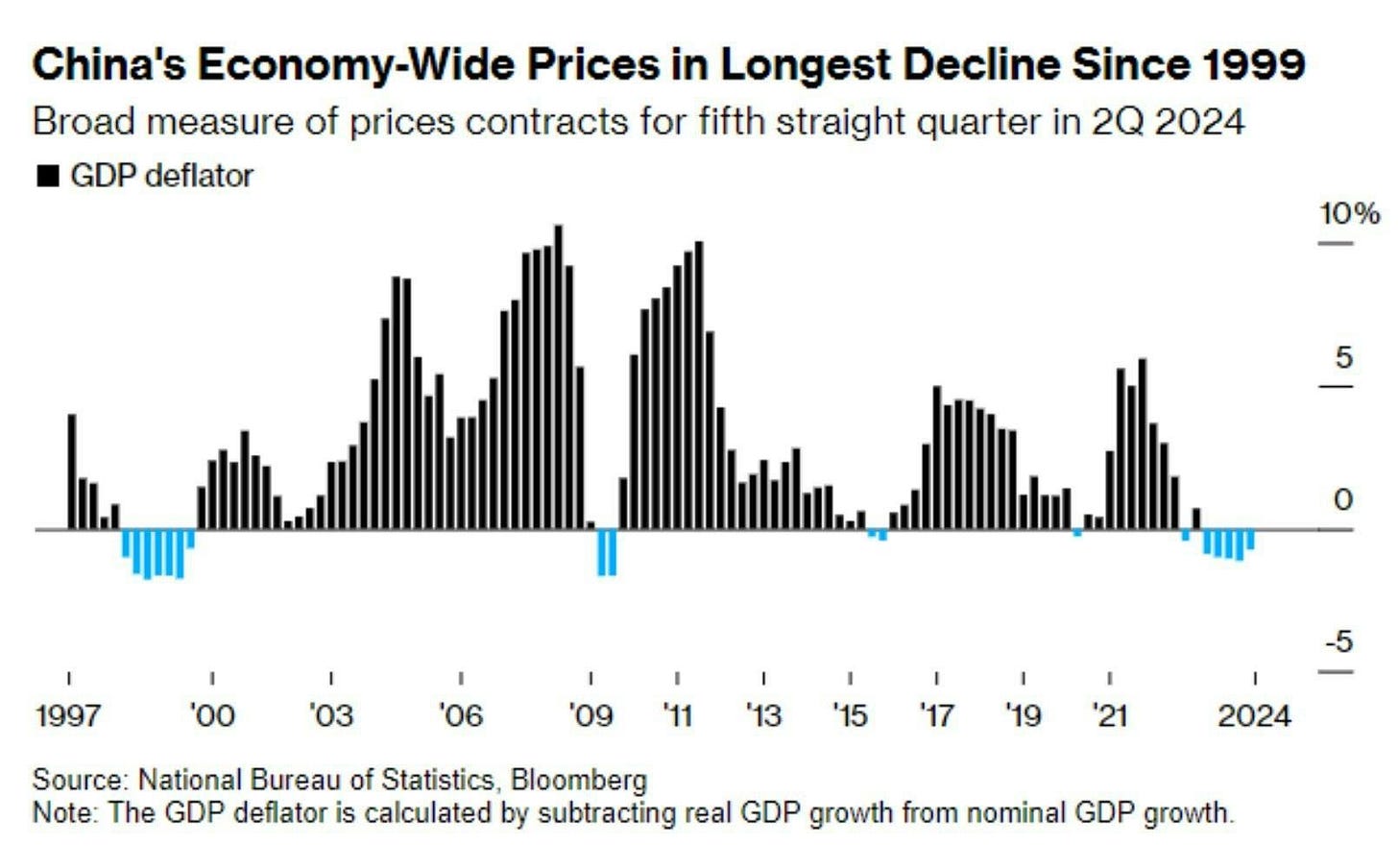

China's latest inflation data suggests the country is teetering on the brink of deflation, with consumer prices rising just 0.6% year-over-year in August, below expectations. Core inflation hit a three-year low of 0.3%, while the GDP deflator has shrunk for five consecutive quarters. This trend raises concerns about potential economic strain, as deflation can lead to reduced consumer spending, company cutbacks, and loan repayment difficulties.

https://finimize.com/content/old-money

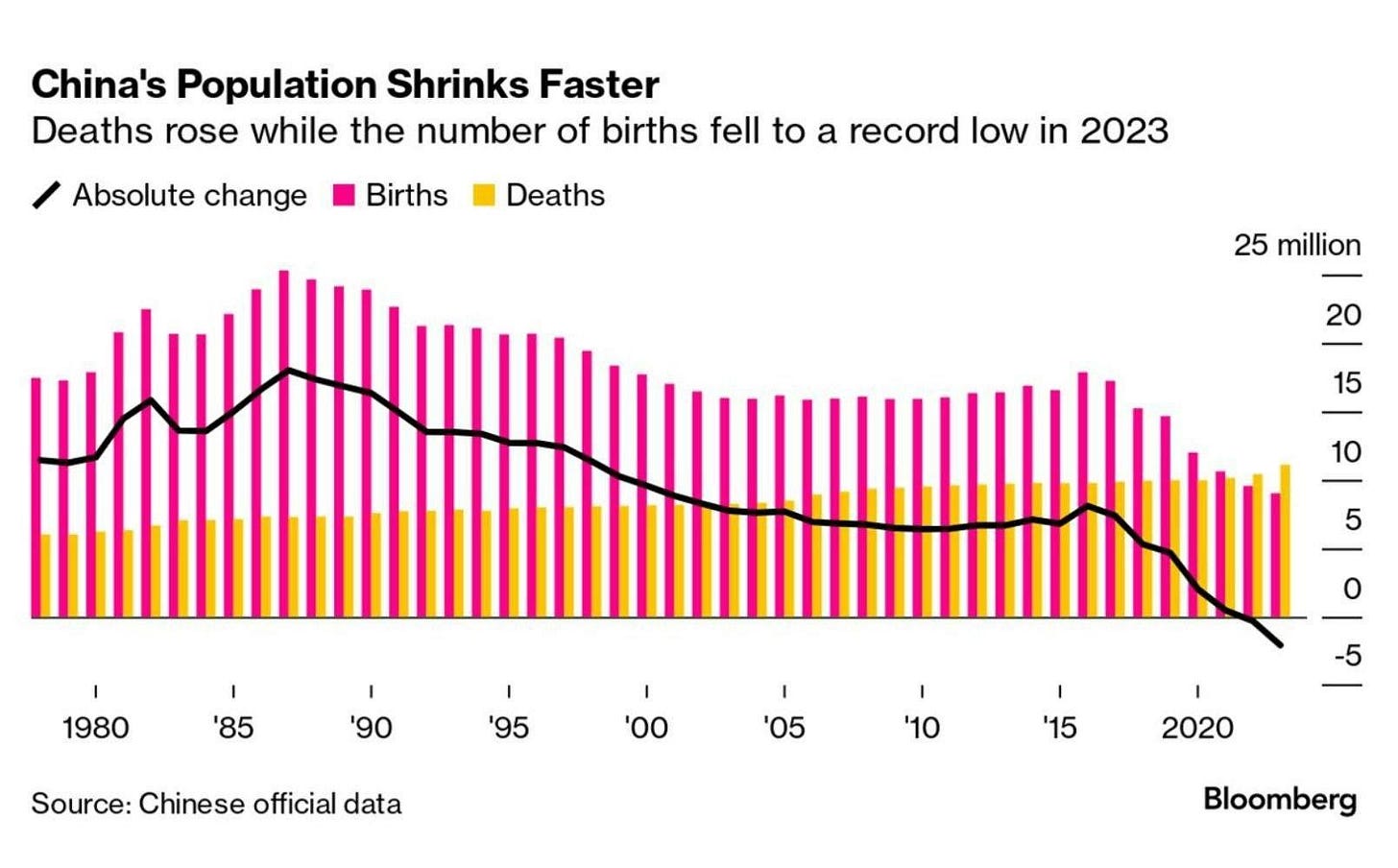

China has approved a plan to raise its retirement age for the first time since 1978, aiming to address its aging population and shrinking workforce. The gradual increase will be three years for men and three to five years for women, despite potential unpopularity amid economic challenges. This change could impact various sectors, including automation, healthcare, and the "silver economy."

https://www.apolloacademy.com/us-wages-vs-wages-in-china-and-india/

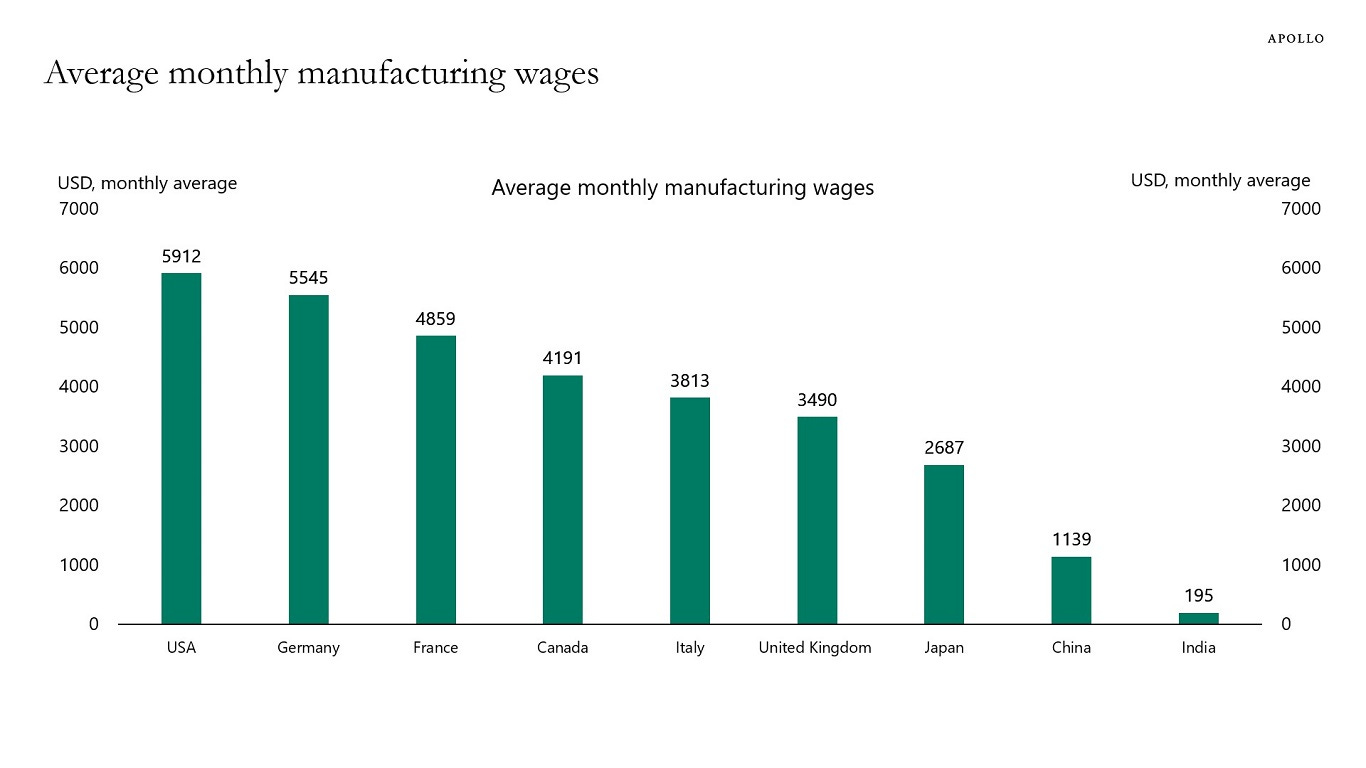

Average monthly manufacturing wages vary significantly across nine countries. The United States leads with $5,912, followed by Germany at $5,545 and France at $4,859. Canada, Italy, and the United Kingdom range from $3,490 to $4,191. Japan's average is $2,687, while China and India have much lower wages at $1,139 and $195 respectively, highlighting substantial disparities between developed and developing economies in the manufacturing sector.

[Finance]

https://www.crescat.net/asset-bubbles-and-inflation/

The Crescat Capital research letter examines potential asset bubbles and inflation risks in the current economic landscape, focusing on tech sector valuations and capital expenditure trends. It questions the Federal Reserve's claim of conquering long-term inflation expectations and explores vulnerabilities of megacap tech companies, particularly in the AI sector. The letter draws parallels between current market conditions and the 2000 dot-com bubble, while also highlighting a potential bullish cycle for the mining industry amidst underinvestment and increasing metal demand.

Today's report reveals Atlanta Fed President Raphael Bostic violated Federal Reserve trading rules, including 154 trades during blackout periods since 2017. This misconduct by a high-ranking economic official raises questions about equal application of laws and erodes trust in institutions. The repeated nature of the violations and Bostic's senior position make this a serious breach of integrity.

https://www.linkedin.com/pulse/great-powers-index-2024-most-important-facts-charts-ray-dalio-fm7le/

Ray Dalio’s Great Powers Index 2024 provides an in-depth analysis of 24 leading countries, focusing on their prospects for the next ten years based on internal and external dynamics, economic forces, and innovation. The report highlights the risks posed by rising internal and international conflicts, particularly between the U.S. and China, which remain the two most powerful nations. Other key concerns include global debt, financial stability, environmental challenges, and technological advancements. The report also projects India to have the strongest economic growth in the coming decade.

https://themarket.ch/english/we-will-see-more-spikes-in-inflation-ld.11975

Kenneth Rogoff, a prominent economist, argues that financial markets are at a turning point. He anticipates higher inflation, interest rates, and volatility in the coming years. Rogoff believes the pre-pandemic economic environment was abnormal, with exceptionally low inflation and interest rates. He expects a return to more typical conditions, citing political pressures, high debt levels, and geopolitical factors as key influences on future economic trends.

Howard Marks discusses the concept of risk in investing, emphasizing that risk is not volatility but the probability of loss. He argues that risk cannot be precisely quantified and is best assessed through subjective judgment by experienced investors. Marks highlights risk's counterintuitive and perverse nature, stressing that it's often highest when perceived as lowest. He advocates for constant risk management, viewing the future as a range of possibilities, and aiming for asymmetry in returns - participating in gains while avoiding losses.

[Geopolitics]

https://www.morningbrew.com/daily/stories/2024/09/11/trump-and-his-new-rival-harris-debate

The first presidential debate between Donald Trump and Kamala Harris centered on key economic issues, with both candidates presenting their visions for addressing inflation, taxes, and trade. Trump emphasized his past economic record and plans for tax cuts, while Harris outlined specific policy proposals. The debate featured sharp exchanges on various topics, with each candidate appealing to different voter priorities and economic philosophies.

https://www.cnbc.com/2024/09/15/trump-gunshots-campaign-golf-course.html

The article reports on a second assassination attempt on former President Donald Trump at his Florida golf course. Secret Service officers fired at a gunman near the property, with Trump unharmed and a suspect in custody. The FBI is investigating the incident, which involved the discovery of an AK-47-style rifle and other suspicious items near the scene.

https://www.visualcapitalist.com/net-migration-which-regions-are-gaining-or-losing-people/

The graphic visualizes global net migration patterns from 1950 to 2023, revealing consistent population gains in Northern America, Europe, and Oceania through immigration, while Latin America, Africa, and Asia generally experience net population losses. The data, sourced from UN World Population Prospects 2024, highlights regional disparities in migration flows, reflecting economic opportunities, political stability, and global events influencing human movement across continents.

https://www.visualcapitalist.com/mapped-how-populations-have-changed-in-the-americas-1990-2023/

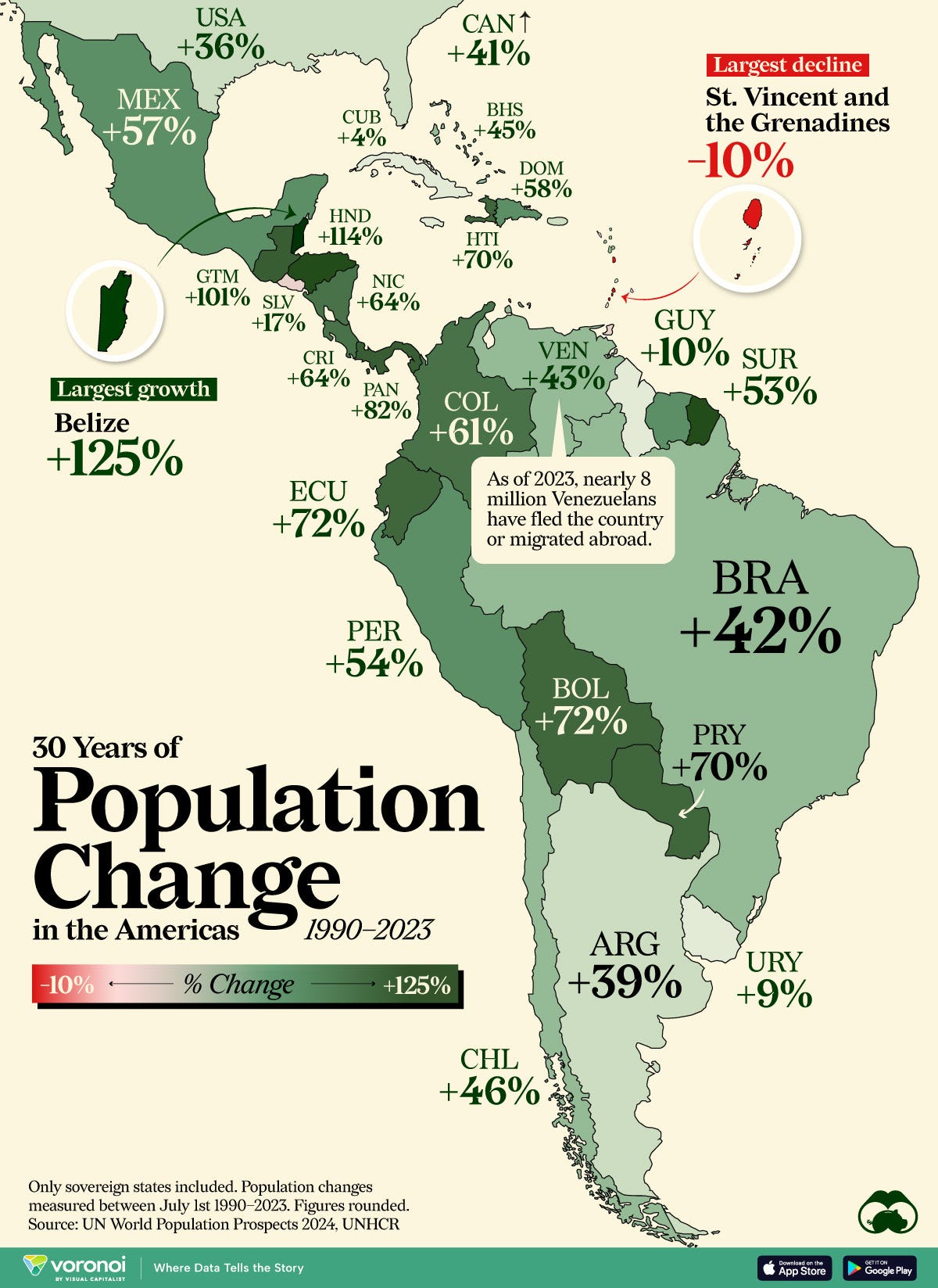

Since 1990, most countries in the Americas have experienced significant population growth, with only a few exceptions. The United States, Brazil, and Mexico, the three most populous nations, saw substantial increases in their populations. Guatemala doubled its population, while Belize had the highest percentage growth at 125%.

Neil Howe: We May Suffer A Collision of Financial, Social & Geo-Political Crises All At Once

Neil Howe discusses the looming risk of multiple, simultaneous crises—financial, social, and geopolitical. He emphasizes that the U.S. may face economic instability, political gridlock, and escalating external threats in tandem, rather than in sequence. While inflation and financial repression are highly likely, Howe notes that deeper societal divides could amplify the turmoil, especially following upcoming elections. Drawing parallels with previous turning points in history, he warns that we may be entering an era of profound change, where institutional restructuring and difficult decisions are inevitable.

[Energy]

https://www.visualcapitalist.com/charted-chinas-energy-needs-keep-on-rising/

China's electricity demand has grown exponentially since the 1990s due to rapid industrialization, urbanization, and improving living standards. By 2025, China's electricity demand is forecasted to reach 10,498 TWh, more than double that of the United States at 4,475 TWh. This growth far outpaces other major economies like the EU and India, reflecting China's massive scale and continued development. Urbanization is a key driver, with cities now surpassing industry as China's largest energy consumers.

Asia, led by China, is spearheading a global effort to more than double the count of nuclear power reactors worldwide. The chart displays existing and planned nuclear reactors across various countries, with China far outpacing others in both current capacity and future plans. Other nations show varying degrees of nuclear development, with some focused on expansion and others maintaining current levels.

OPEC's influence on global oil markets is waning due to increased competition from US shale production, the rise of natural gas as an alternative, and geopolitical shifts. The cartel's failed price war against US producers in 2014, recent member defections, and technological advancements in the energy sector are contributing to its decline. Despite temporary reprieves from global events, market forces and the blurring line between oil and natural gas markets suggest OPEC's 65-year dominance over oil prices may soon end.

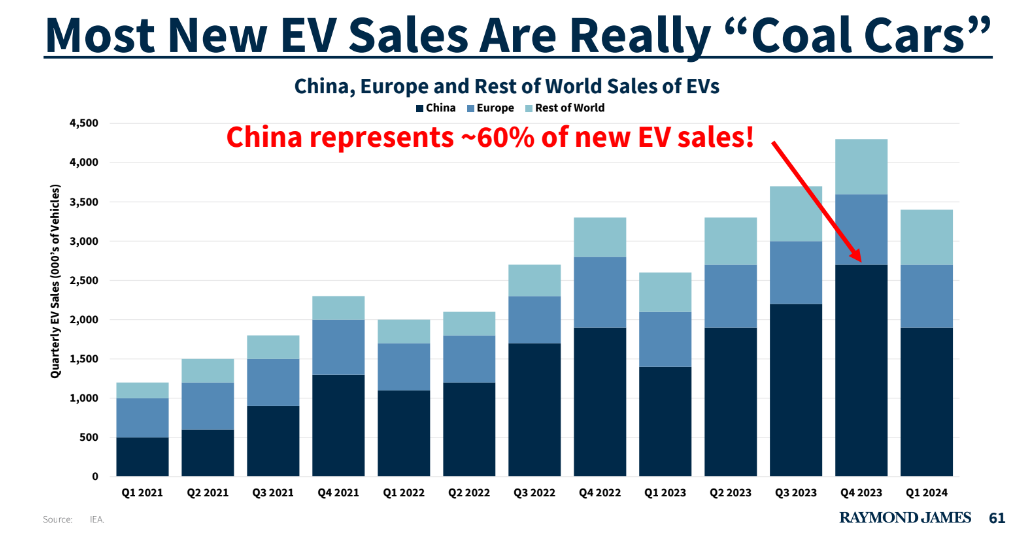

Despite the growth of electric vehicles (EVs), European demand for gasoline continues to rise, challenging the narrative that EV adoption will rapidly displace fossil fuels. One of the key points behind this reality is the significant reliance on China for the production and sale of EVs. China accounts for approximately 60% of all new global EV sales, yet about two-thirds of the energy used to power these vehicles comes from coal. This undermines the perception of EVs as a clean alternative to traditional vehicles, as they are indirectly tied to coal consumption.

https://www.apolloacademy.com/wp-content/uploads/2024/09/090924_Chart.pdf

The percentage of homes with air conditioning varies dramatically across countries, with Japan, the United States, and Korea having the highest rates at over 85%. Saudi Arabia and China follow with 63% and 60% respectively. Developing nations like Mexico, Brazil, and Indonesia have much lower rates, while India has the lowest at just 5%. This disparity suggests significant potential for increased energy consumption as AC adoption grows in less-developed countries.

[Commodities]

https://think.ing.com/articles/gold-monthly-golds-rally-is-just-getting-started/

Gold has surged over 20% year-to-date, driven by anticipated Fed rate cuts, strong central bank buying, and robust Asian demand. The metal's rally has also been supported by geopolitical risks and uncertainty ahead of the US election. Federal Reserve Chair Jerome Powell's recent statements at Jackson Hole have further bolstered expectations of imminent rate cuts, which typically benefit non-yield-bearing assets like gold.

https://finimize.com/content/not-so-steely-nerves

China's steel overproduction has led to a 20% price drop this year, with factories selling at a loss and exporting at levels unseen since 2016. This has prompted protective measures from Europe, while China's tech industry push and rare earth mineral leverage complicate global trade dynamics. Meanwhile, the struggling Chinese property market affects commodity prices, with gold emerging as a standout performer.

[Business]

https://www.theverge.com/2024/9/14/24243794/tiktok-ban-bytedance-court-oral-arguments-lawsuit-explainer

TikTok is facing a legal battle as the US government seeks to force its sale, citing national security concerns. The case, to be heard on September 16th, centers on classified evidence that TikTok cannot access. The government argues TikTok poses risks due to potential Chinese government influence, while TikTok claims the ban is unconstitutional. The court's decision, expected in December, could significantly impact the platform's future in the US.

[Real Estate | USA]

https://www.apolloacademy.com/wp-content/uploads/2024/09/USHousingOutlook_091024.pdf

The US housing market recovery continues, driven by low supply, but demand is softening due to high mortgage rates, prices, and rising unemployment. Housing supply remains constrained, with an estimated deficit of 2.3 million homes. Despite affordability challenges, home prices have shown resilience, supported by the supply shortage. Rental markets are experiencing rising rents and low vacancy rates. Demographics remain supportive, but risks include potential further rate increases, unemployment growth, high construction costs, and incoming multi-family supply.

https://smartasset.com/data-studies/where-high-earning-households-are-moving-2024

The SmartAsset study analyzes migration patterns of high-earning households (those making $200,000+ annually) across U.S. states, using IRS data from 2021-2022. Florida emerged as the top destination, gaining 29,771 net high-income households, while California lost the most at 24,670. The study reveals significant wealth movement to southern states like Texas and the Carolinas, with potential economic impacts on both gaining and losing states.

[Crypto]

10x bigger than Bitcoin, Tether, and Gold: China's Central Bank Digital Currency will dwarf them all

China's central bank plans to leverage its vast US dollar reserves to create a digital currency system, potentially revolutionizing global finance. This initiative, centered in Hong Kong, aims to establish a stable coin ecosystem that could rival existing financial networks. By utilizing their $3.25 trillion in official reserves, China seeks to dominate digital currency markets, bypassing traditional banking systems and challenging US financial dominance.

https://watcher.guru/news/el-salvador-to-use-crypto-for-trade-with-brics-ditching-the-us-dollar

El Salvador proposes using cryptocurrency for trade with BRICS nations, particularly Russia, to move away from the US dollar. This follows Russia's recent legalization of crypto for international trade, aimed at circumventing Western sanctions. The move could simplify trade dealings and potentially lead to El Salvador joining BRICS, signaling a shift in global economic dynamics and a challenge to dollar dominance.

https://www.forbes.com/sites/sarahemerson/2024/09/11/adam-neumanns-climate-company-is-issuing-refunds-after-failing-to-launch-crypto-token/

Flowcarbon, an environmental tech startup co-founded by former WeWork CEO Adam Neumann, has failed to launch its promised cryptocurrency token despite raising significant funds. The company is now returning money to token buyers, raising questions about Neumann's ability to deliver on hyped ventures and the due diligence of high-profile investors.

[AI]

https://x.com/polynoamial/status/1834280155730043108

OpenAI has released a new AI model called o1 (internally known as "Strawberry") with enhanced reasoning capabilities. This model is designed to "think" before responding by using a private chain of thought, allowing it to handle complex reasoning tasks more effectively than previous models. The o1 series represents a new scaling paradigm for AI, focusing on inference compute rather than just pretraining.

https://hbswk.hbs.edu/item/what-happens-when-business-owners-turn-to-chatbots-for-advice

This working paper examines the impact of generative AI on entrepreneurial performance through a five-month field experiment with 640 Kenyan entrepreneurs. Participants were randomly assigned to receive either a standard business guide or AI-generated advice via WhatsApp. The study found no average treatment effect, but revealed heterogeneous impacts: high-performing entrepreneurs benefited from AI advice with a 20% increase in performance, while low performers experienced a 10% decline. Analysis of interaction logs suggests that low performers sought AI assistance for more challenging business tasks, potentially explaining the disparity in outcomes.

https://finimize.com/content/buddy-system

Elon Musk has suggested a strategic alignment between Tesla and xAI, two of his companies, where Tesla could license xAI’s advanced AI models for its self-driving software and voice assistant. This collaboration would benefit both companies financially, with xAI gaining a share of the related revenues. While Tesla seeks AI-driven improvements, especially in its self-driving technology, it faces challenges in China, where its market share has fallen due to competition from local EV brands. Investors are cautious about Musk’s deep involvement with xAI, fearing it may overshadow Tesla or other ventures.

https://www.newyorker.com/culture/the-weekend-essay/why-ai-isnt-going-to-make-art

Ted Chiang argues that AI, despite its capabilities, is fundamentally unsuited to creating meaningful art because art is the result of countless intentional choices that AI cannot replicate. While AI can generate coherent text or images, these creations lack the subjective experiences and decisions that define true artistic expression. Chiang emphasizes that art, whether a novel or painting, derives its value from the creator’s unique intentions and life experiences, aspects that AI, which operates without understanding or intent, can never replicate.

https://www.wired.com/story/nanowrimo-organizers-classist-and-ableist-to-condemn-ai/

NaNoWriMo, a nonprofit known for encouraging writers to complete a novel in a month, sparked outrage after issuing a statement suggesting that condemning AI technology in writing has “classist and ableist undertones.” The statement led to backlash from authors and participants, with several board members resigning in protest. Critics argue that using AI diminishes the creative process and exploits content from published writers. The controversy highlights growing tensions around AI’s role in creative fields and has alienated many of NaNoWriMo’s long-time supporters.

[Miscellaneous]

https://edition.cnn.com/2024/09/06/science/boeing-starliner-return-without-astronauts/index.html

Boeing's Starliner capsule successfully returned to Earth from the International Space Station, concluding a nearly three-month mission without astronauts on board. The capsule undocked from the ISS, performed a controlled reentry, and landed safely in New Mexico using parachutes and airbags. This test flight faced several challenges, including thruster issues and helium leaks, which led NASA to decide against bringing the crew back on Starliner.

https://www.morningbrew.com/daily/stories/2024/09/08/onlyfans-has-a-lot-of-fans

OnlyFans, the popular content subscription platform, continues to experience remarkable growth even after its pandemic-driven boom. The company reported impressive financial results for the fiscal year ending November 2023, with revenue increasing by 20% to $1.3 billion and profits also rising 20% to $485.5 million. User engagement has surged, with creator numbers up 29% to 4.1 million and users growing 28% to 305 million.

https://www.mentalfloss.com/posts/match-last-words-to-the-person-who-said-them-quiz

A recent analysis by Wordtips revealed that the United States leads globally in the use of profanity on social media, with 41.6 out of every 1,000 tweets containing a swear word. The UK, Australia, and New Zealand also ranked highly in linguistic profanity. Conversely, countries in the Middle East, such as Kuwait, had the lowest levels of swearing. On a city level, Baltimore topped the list in North America, while South America’s most profane city was Cali, Colombia. The least profane continent was Asia, with Singapore leading in swear word usage.

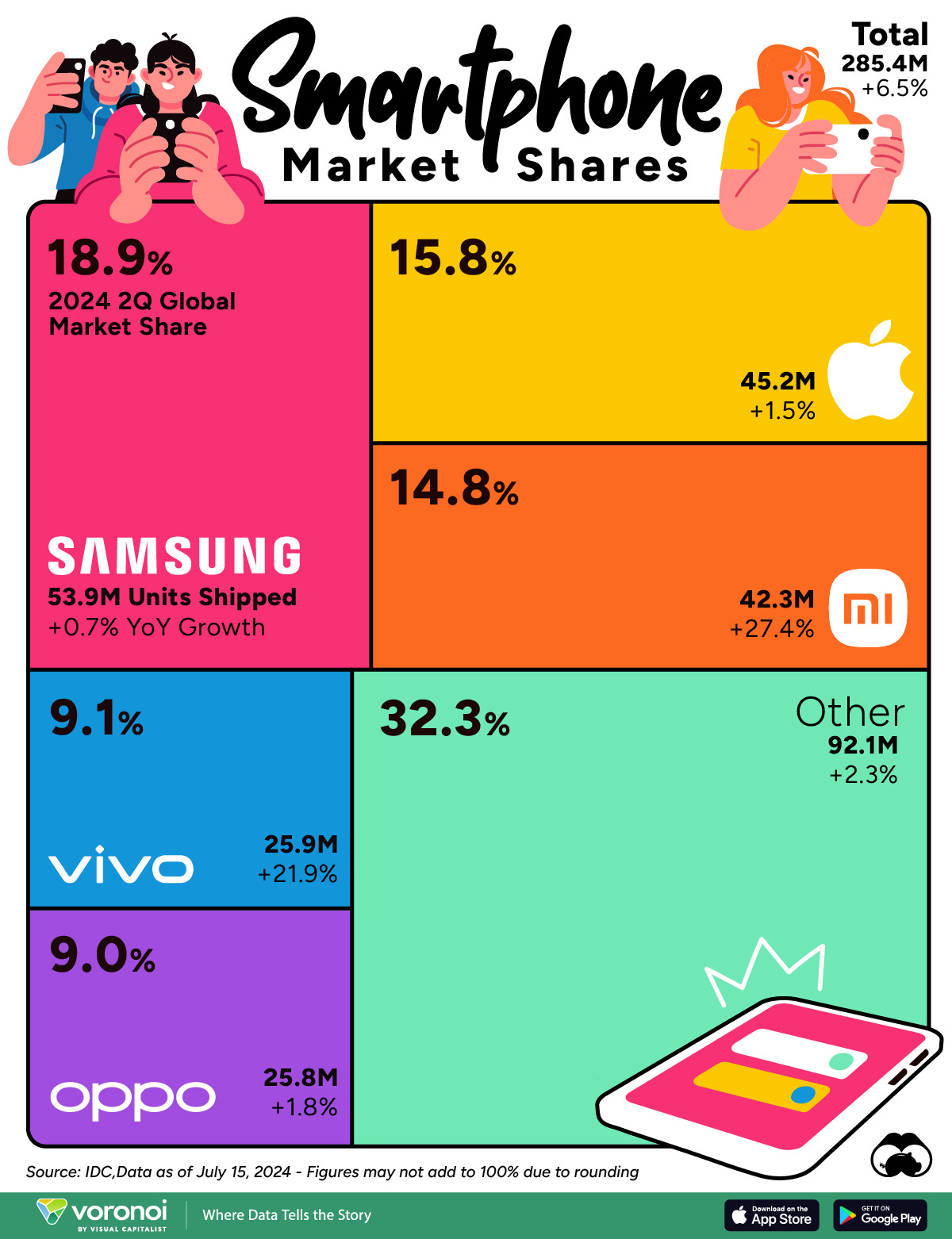

https://www.visualcapitalist.com/the-top-companies-by-global-smartphone-market-share/

Samsung and Apple dominate the global smartphone market, with Samsung leading in 38 countries and Apple in 16. Both companies are integrating AI features into their devices. Chinese manufacturers like Xiaomi, vivo, and OPPO are gaining ground, with Xiaomi tripling its market share over the past decade. Despite maintaining the top position globally, Samsung's market share has declined from 24.8% to 18.9% in ten years.

[Song of the Week]

[Disclaimer]

This newsletter presents a curated selection of intriguing content from the past week. It is intended solely for informational and educational purposes. The material shared does not constitute financial advice, investment recommendations, or an endorsement to buy or sell any assets. Readers should conduct their own research and consult qualified professionals before making any investment decisions. The views expressed in the curated content do not necessarily reflect our opinions, and we cannot guarantee the accuracy or completeness of the information provided.